Trump’s tariffs are expected to cost the average U.S. household $4,900 per year, weaken the U.S. dollar relative to foreign currencies, and threaten a recession that will eat into retirement savings and drive U.S. businesses to bankruptcy. Tariffs have been and will continue to be economically disastrous for most Americans, yet a select few have benefited from the market’s volatility, leading to calls for an investigation into insider trading and market manipulation.

Just two days after the tariff delay, six Democratic senators sent a letter to the Securities Exchange Commision requesting an investigation into potential “insider trading, market manipulation, or other securities laws violations” related to the April 9 tariff announcement. The letter, signed by Elizabeth Warren and Chuck Schumer, among others, urged the S.E.C. to “restore Americans’ faith in the rule of law and to preserve the integrity of the financial system,” but failed to produce significant evidence of any transgressions. Even without this direct evidence, many Democrats believe there is enough to warrant an investigation and congressional hearings.

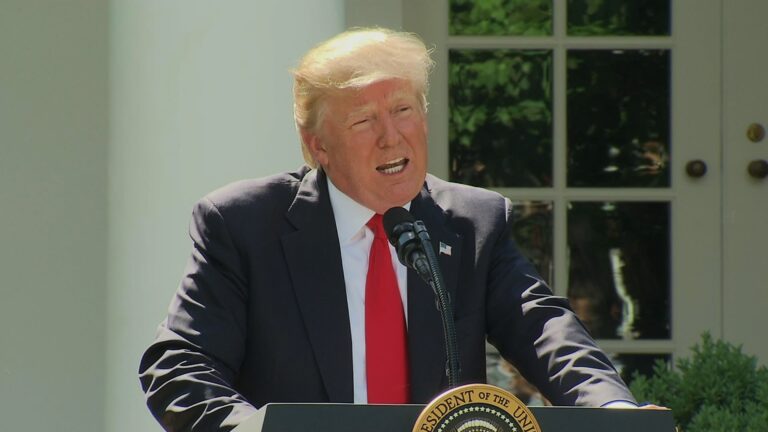

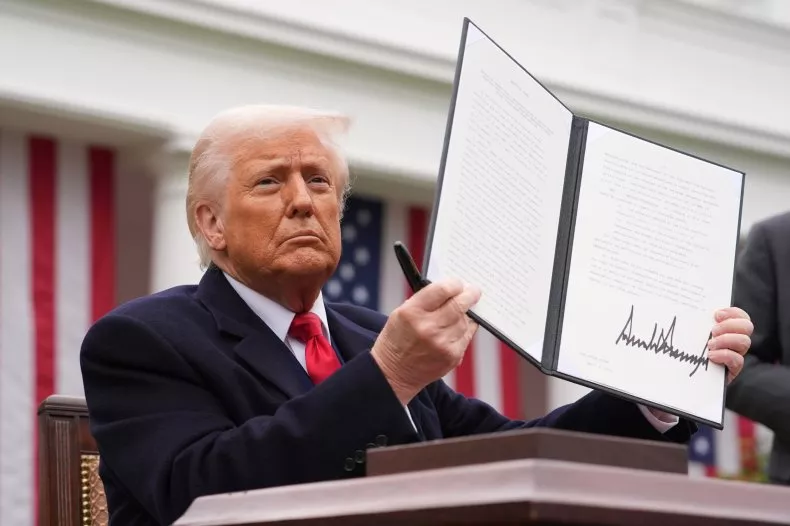

Market manipulation occurs when “someone artificially affects the supply or demand for a security,” making this case appear relatively clear-cut on paper. On the morning of April 9, Trump “Truthed” out the message, “THIS IS A GREAT TIME TO BUY!!! DJT.” Given his knowledge of the impending tariff delay, Trump encouraging his followers to buy seems like an obvious example of market manipulation. Moreover, he ended the Truth with the initials D.J.T., obviously his initials, but also the ticker for Trump Media and Technology Group Corp., the company that owns Truth Social. Whether or not Trump intended to promote Trump Media, its stock closed the day at 22.67 percent, double the increase of the overall market.

In response to these market manipulation accusations, White House spokesperson Kush Desai called it “the responsibility of the President of the United States to reassure the markets and Americans about their economic security in the face of nonstop media fearmongering.” It would be nearly impossible to prosecute Trump over this message, particularly given his role as president. University of Michigan finance Professor Nejat Seyhun noted that presidents incidentally move markets “all the time,” and if Trump were to call his Truth an official presidential act, he would be exempt from prosecution under last year’s Supreme Court ruling.

The case for insider trading, on the other hand, appears more tangible. Insider trading occurs when individuals buy or sell securities based on material, nonpublic information. If Trump were to have tipped off individuals about his tariff announcement or his subsequent 90-day delay, both he and the recipients of the tip would be liable to insider trading charges.

In Congress, Rep. Rob Bresnahan sold off $50,000 worth of Alibaba stock just before Trump doubled the tariff on Chinese imports, and Rep. Marjorie Taylor Greene bought between $21,000 and $315,000 worth of stock between April 8 and April 9, just before the tariff delay. Studies show congressional trading increases “when economic policy uncertainty and equity market volatility are high,” an indicator that there may be more involved than just a reliable financial advisor. Congressional trading has long gone unpunished, however questionable the transactions, so it is unlikely that these trades will lead to anything material in terms of consequences.

Outside of Congress, sources close to the Democrats’ investigation reported that at least three hedge fund managers who dined at Mar-a-Lago on March 30 “dramatically increased their short positions in the 48 hours following that dinner,” a bet that paid off massively after the tariffs were announced. An anonymous senior Wall Street trader said these stock positions were so focused on companies with Chinese supply chains while omitting domestic manufacturers that “It looked like someone had a detailed breakdown of which sectors would be hit hardest.”

Democrats also point to a significant wave of call options around 15 minutes before Trump’s tariff delay. In other words, these investors were betting on the market to rebound by the end of the day. Reuters reported a purchase of 5,105 call options for the S&P 500 worth a total of $2.14 million to over $21 million.

Still, proving foul play in either case remains extremely difficult. Amid the chaos and volatility of tariff-driven markets, distinguishing between savvy speculation and insider trading is nearly impossible. Under a different president, there may be enough to at least warrant an investigation. Republican members of Congress, business associates, and anonymous big-time investors all making such well-timed moves does raise questions, along with Trump’s Truth Social post. The Democrats’ calls for an investigation are not simply an unsubstantiated attack on Trump; however, they have yet to produce a clear smoking gun.

Even if compelling evidence were uncovered, Trump’s grip on the executive branch means any real action from the S.E.C. or D.O.J. is unlikely. The burden of proof lies with those calling for an investigation — and without it, those calls are destined to go unheeded.

The Zeitgeist aims to publish ideas worth discussing. The views presented are solely those of the writer and do not necessarily reflect the views of the editorial board.