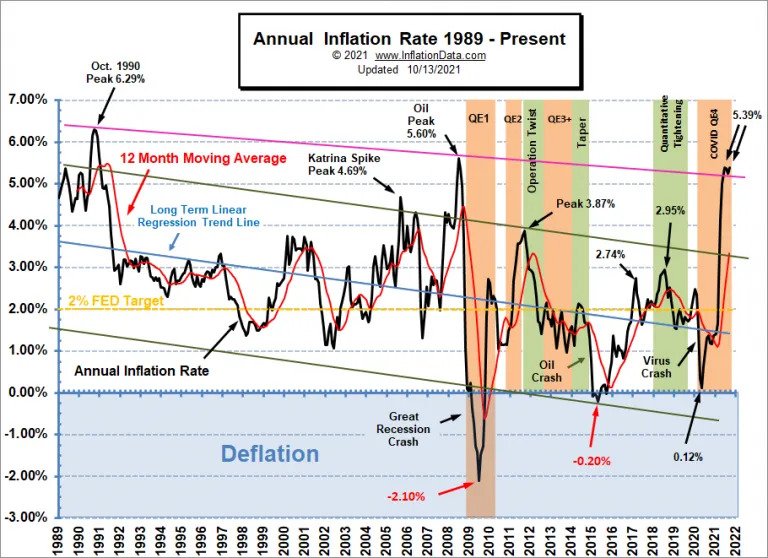

In the last 12 months, the United States has seen inflation run rampant. The Consumer Price Index shows that everyday necessities have gotten more expensive. Medical services, transportation services, and means of shelter (rent, house prices, etc.) are all experiencing inflation but the most shocking numbers come from raw resources, food goods, and energy. Most food items like fruit or grains have hovered around an inflation of 5 percent, but other goods like meat and fish report inflation over 10 percent. Gasoline, electricity, and energy usage, in general, have gone up around 40-50 percent in value and raw materials like metal and wood have nearly doubled in price.

Everyone has felt the effects of 2021’s inflation, from steep gas prices to not being able to afford sufficient food, shelter or power for their homes. So, why is inflation happening?

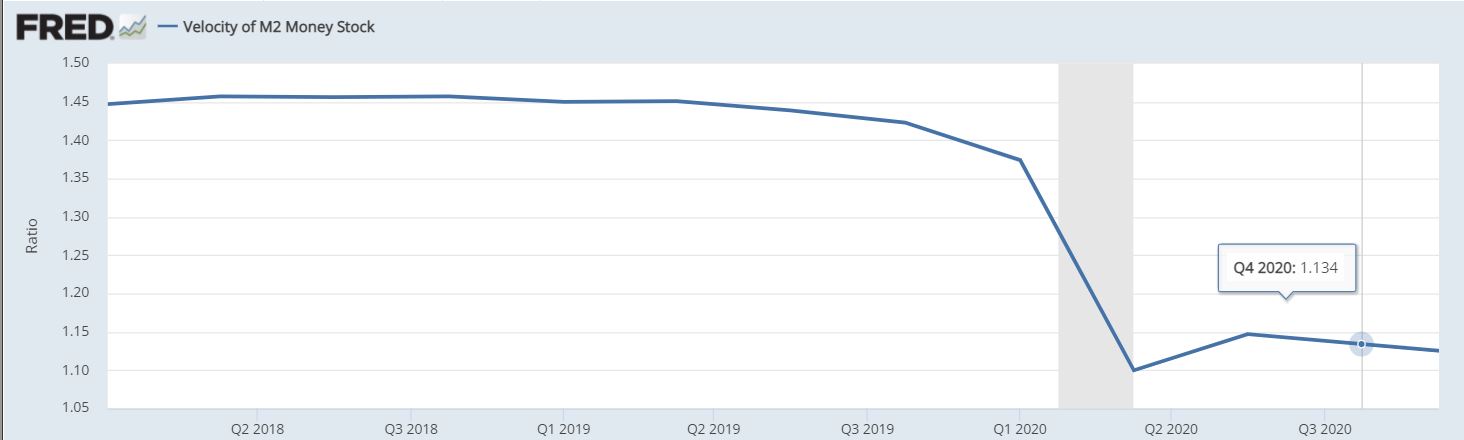

In a very basic breakdown of complex economic processes: the loosening COVID restrictions, increased number of vaccinated people, and the return of workers to normal job conditions are responsible. Under COVID the supply of money in the economy reached record lows. People were forced to be more fiscally conservative since the future was uncertain. Most only spent money on the necessities: food, clothing, and shelter, and they cut down on excessive spendings like luxury items or entertainment. Economist David Henderson has labeled the pandemic as the biggest example of “money hoarding” in the 21st century.

Everything changed in early 2021 when the vaccines went on the market. Infection rates would decline slowly and so rules were relaxed. Schools, theatres, and malls reopened. Millions of people finally left their homes and spent their money on more than essentials. The United States economy was shocked by billions of dollars of increased spending very suddenly. The increased demand for goods and services, therefore, skyrocketed prices.

Now it is time for the general population’s favorite part of economics articles and economists’ least favorite: predictions. Given everything, do I predict inflation itself gets better? Probably not. 2022 will likely see continued inflation. We are still coming out of a 2-year pandemic where the money supply was extremely low. People’s spending will continue to increase and therefore inflation will progress.

However, there is light at the end of the tunnel. There is hope. Not that inflation will decrease, but rather in the form of economic growth. If the growth of Real GDP continues to be higher than inflation, consumers will not be affected by any more inflation that may occur. The increased spending and economic activity should also cause this. As more goods are being bought, more people will gain and regain their occupations, and so more processing and manufacturing must be done. The economy should theoretically start to come out of the COVID recession and go back to pre-pandemic growth levels. The recency of all the new spending means this has not occurred, yet but most economists predict it will.

All this being said, there is a significant caveat to the hope provided by Real GDP growth: The Biden Administration. They have already made changes that significantly hinder post-COVID economic growth: they added 300 dollars to the weekly unemployment benefit (over 1.9 trillion dollars in the coming months) which will discourage millions of working-class people to take jobs or return to their pre-pandemic jobs. To be fair to Biden, when he did this, he was only amending a Trump era law (The CARES Act) that had already added 600 dollars to weekly benefits. He has also a record number of numerous regulations ranging from showerhead water use limitations to regulation of U.S Bank accounts over 10,000 dollars. These regulations stop businesses from adding value to the economy at levels that can supersede inflation and control consumer prices. Biden’s policies put all of us in danger of not bouncing back.

Despite everything, my prediction today is that everything will get better in the next few months. Biden’s policies, even though they impact growth negatively, are not yet enough to stop the influx of resources companies are getting. Early next year, prices should start to be stable once again. Better days are on the horizon.